Not Every Family Needs “Full Service”

The past couple of weeks we’ve been looking at “connecting” with members of client families and then matching the solutions we have to these families.

All this made me consider one of the biggest questions that people often have for me when they learn about the kind of work I do.

The questions come in a variety of forms, but generally boil down to this: “Who ARE these families that actually do all of this governance stuff?”, along with “where do you find them?”.

If you stopped 100 random people on the street, you likely wouldn’t meet any people from such families, and very few would even have a personal connection to one.

However, if you shared the names of families who continually work on their governance, those names would be recognizable to most.

Are We “Exceptional”; Do We Even Want to Be?

Not every family is destined to be exceptional, and many don’t envision themselves as such either.

For some families, just imagining themselves in this way is actually unnatural and even abhorrent.

Too often, though, professionals who serve families who’ve achieved a certain level of wealth creation begin to make assumptions about what these families should be doing to preserve that wealth.

Well crafted strategies to minimize taxes and keep financial wealth protected have become the go-to starting point for such families, because a whole industry of professionals exists to take care of these issues.

I’m always wary of situations where the tail ends up wagging the proverbial dog, and for me the “dog” is the family.

I prefer to help the family figure out what makes it exceptional and then plan for ways to grow and preserve that.

Once the family has set those priorities, by all means then let’s get the professionals involved to figure out the best strategies to employ to help accomplish that.

Many Varieties and Versions, and Ways to Make Progress

Some families will have an operating business that they wish to preserve, and finding ways to ensure that it continues to evolve and thrive with the economy, while still being owned by the family, might be their focus.

Others may have had a liquidity event, and are now searching for new opportunities, either through direct investing or philanthropy, or both, and incorporating the rising generation of their family into those projects will take center stage.

Still others may be searching for ways to recreate the entrepreneurial spirit and create a “family bank” that will allow their offspring and all of their human capital to thrive in their own ways.

There are so many possibilities, and the path chosen will vary from one family to the next.

No Two the Same = All ARE Exceptional

And because no two families are the same, they ‘re each potentially exceptional in their own right.

Too often, as advisors, we want to show how smart we are and we rush to get the family moving on our pet project for them, and that where we may be doing them a disservice, hurrying them into action.

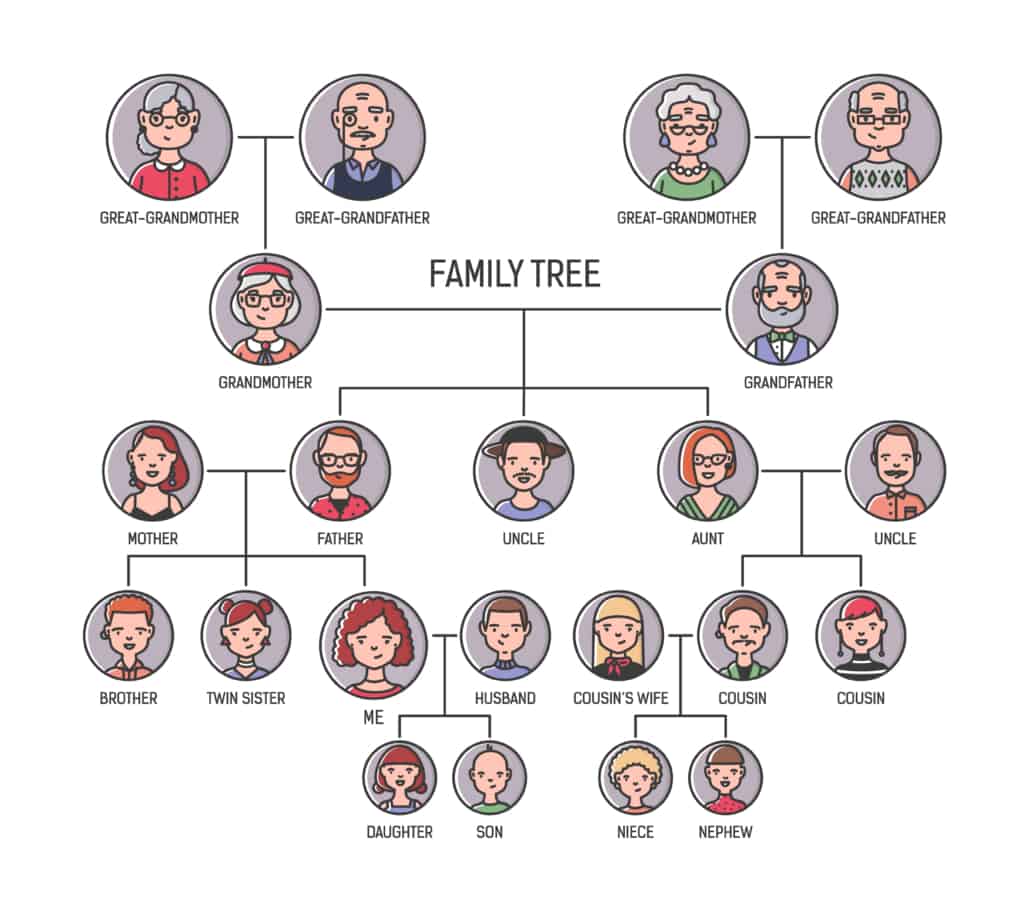

A family is a system of many moving parts, and it takes time to engage all of those people properly, to the point where they even understand and believe that there may be a “family project” that will arise from the financial resources that have been created, by previous generation(s) of their family.

Vision, Mission, and Values Work

Some colleagues reading this will nod their heads and agree that helping the family identify its values and then figure out a vision and mission are great first steps, and in many ways I agree with them.

I’m advocating for more basic connection work in advance of those specific projects, which then become more clear with time.

Discovery work with such families can take months before recognizing where we should actually begin to co-create a family project together.

Yes, the values need to be surfaced at some point, typically early on. But then the mission and vision need to be carefully considered in the context of where the family is now, and what its capacity is to undertake its first steps together in new ways.

An Iterative Process, More Journey than Destination

We’re talking about a family journey over the coming decades together, so there should be no rush to complete the plan in days or weeks.

It should be an iterative process; more about a journey than a destination.