This week we’re going to look at an interesting model that I came across last year, and talk about how it might apply to enterprising families.

When I first saw it, I mistakenly thought that it was already quite well known, but it doesn’t seem to be.

At the FFI conference last fall in London, one of the presenters had it on a Powerpoint slide and asked how many people were familiar with it. With dozens of people in the room, I was one of less than a handful of people to raise my hand.

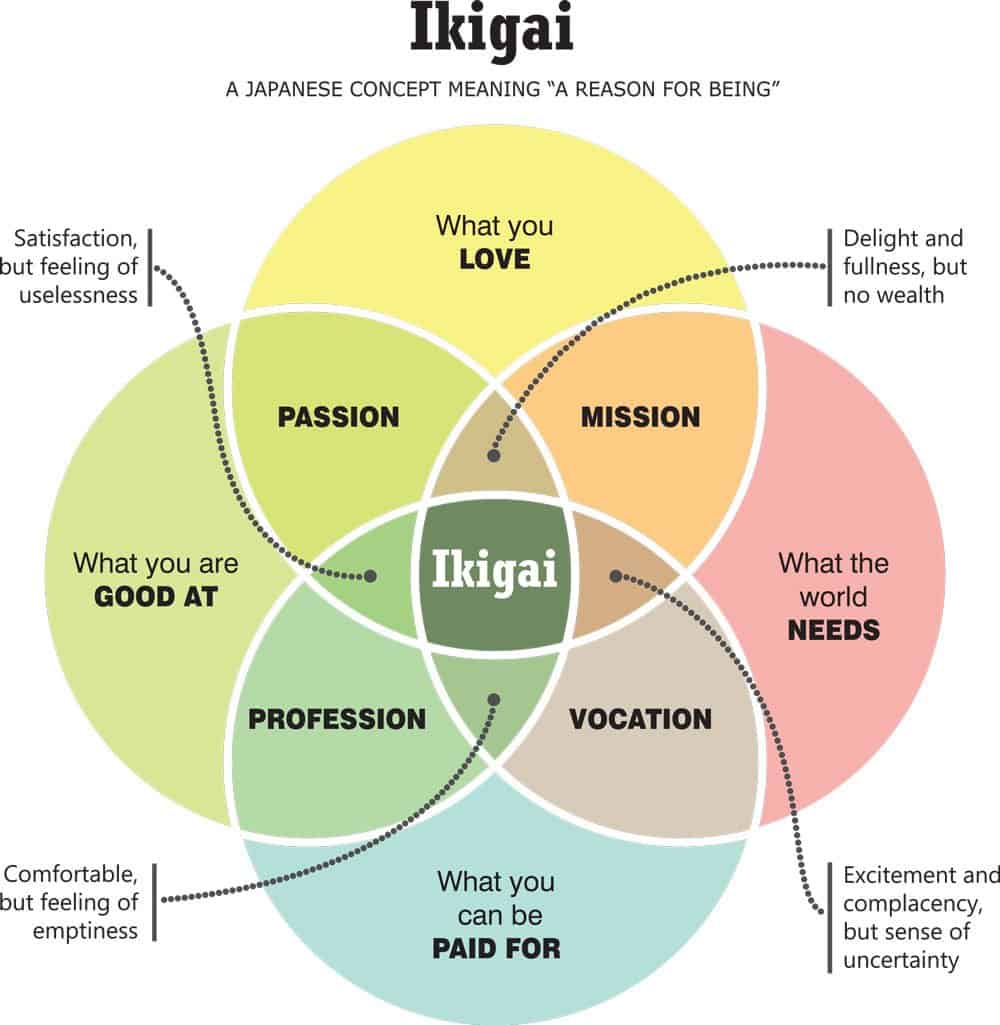

The model comes from Japan and is called Ikigai, and the sub-title of the graphic I found calls it “A Japanese concept meaning ‘A reason for being’”.

Pretty Heady Stuff

I guess that makes it seem like pretty heady (and potentially “heavy”) stuff, but I promise not to go too far afield here.

As usual, I want to look at how things affect families, whether they run a business, have a family office or are simply part of the “ultra-high-net-worth” set, and are concerned with raising their offspring to have meaningful lives.

For most parents, few things are more important than raising our children, with the long-term goal of having them turn out to be well adjusted and happy.

Some adopt a pretty laissez-faire attitude towards their offspring’s career goals, while others are quite directive.

What You Love, What You’re Good At

The old standards of “do what you love” and “find something that you’re good at” are still as pertinent as ever when we try to guide our children as they make choices while they’re coming of age.

Of course there are a number of other considerations that also come into play, and the Ikigai brings up a couple of them.

Some people will look at the other dimensions and quickly agree that they are also important, but my point here today is that they don’t necessarily apply equally to everyone.

Show Me The Money

In addition to loving what you do and being good at it, for most people it’s also important to get paid for their work, so finding something that you can be well paid for is often very important as well.

Notice that I said “often”, and not always, because I’m not talking about “most people”.

Families that have already succeeded at accumulating significant wealth can prove to be important exceptions here.

What the World Needs

Personally, I’ve seen other models that noted the three aspects we’ve already covered, but the one “new” or added dimension is the one where you also consider “what the world needs” in the mix.

This seems to fit quite nicely with the way many Millennials are typically portrayed.

More than ever, it seems that many in the younger generation truly care more about the collective than they do about increasing their own riches.

So in some cases, people may find it more compelling to look for careers where they feel like they are making a positive impact on the world, as a higher priority than making a lot of money.

Different Generation, Different Drivers

Trying to find something that checks all four boxes may seem like a low-percentage game.

That doesn’t mean that it can’t be done or that it isn’t worth trying though.

Plenty of people have done well and lived very rewarding lives while only really “succeeding” in a couple of the four areas, thank you very much.

Many parents have sacrificed a lot and worked at jobs that they never loved but needed to do to provide for their families, with the hope that someday, their kids could have a better life.

The Resource Generation Set

I recently came across an organization that’s attracting many young people from financially wealthy families who want to make a difference in the world.

They call themselves Resource Generation, and appear to want to help create a world with more equitable social justice.

I’m sure that those who are involved must have some very interesting dinner conversations with their families.

It appears that there are indeed some people who are more concerned with the way the world works and less concerned with making money, because they already have plenty.

And I think that the Ikigai model can go a long way in helping families discuss these important subjects together.