This week I’m introducing a subject I first heard about a few years ago, but that has recently been put back on my “front burner”.

I first heard about the concept of a “Family Champion” about five years ago, which would’ve been right around the time that Joshua Nacht was completing his PhD on the subject.

Nacht’s supervisor was Dennis Jaffe, who is quite well known in the circles of the Family Firm Institute (FFI) and the Purposeful Planning Institute (PPI), both of which I was then just discovering.

Like a “Product Champion”?

Decades ago I recall coming across the idea of a “product champion”, while reading some business books.

As I recall, the concept was that you needed to have one really interested and motivated person who really cared about the development of a new product within a company, if it was to have any hope of succeeding.

Later in my career, when our family’s business had successfully licensed one of our patented products to a large company to manufacture and sell in the US, we learned about the importance of a champion, the hard way.

Champ Doesn’t Work Here Anymore

The company we licensed was acquired within the first year of our agreement, and both the VP and product manager we had been dealing with soon left for greener pastures.

Our agreement “survived” the acquisition, but without a “product champion” around anymore, the product we were expecting them to make and sell (and pay us a royalty on) soon became their 99th priority.

We ended up cancelling the agreement shortly thereafter.

From that point on, the idea of a “champion”, as someone who cares about something and who will assume a leadership role in making sure things happen, became seared in my memory.

Family Circle Issues and Governance

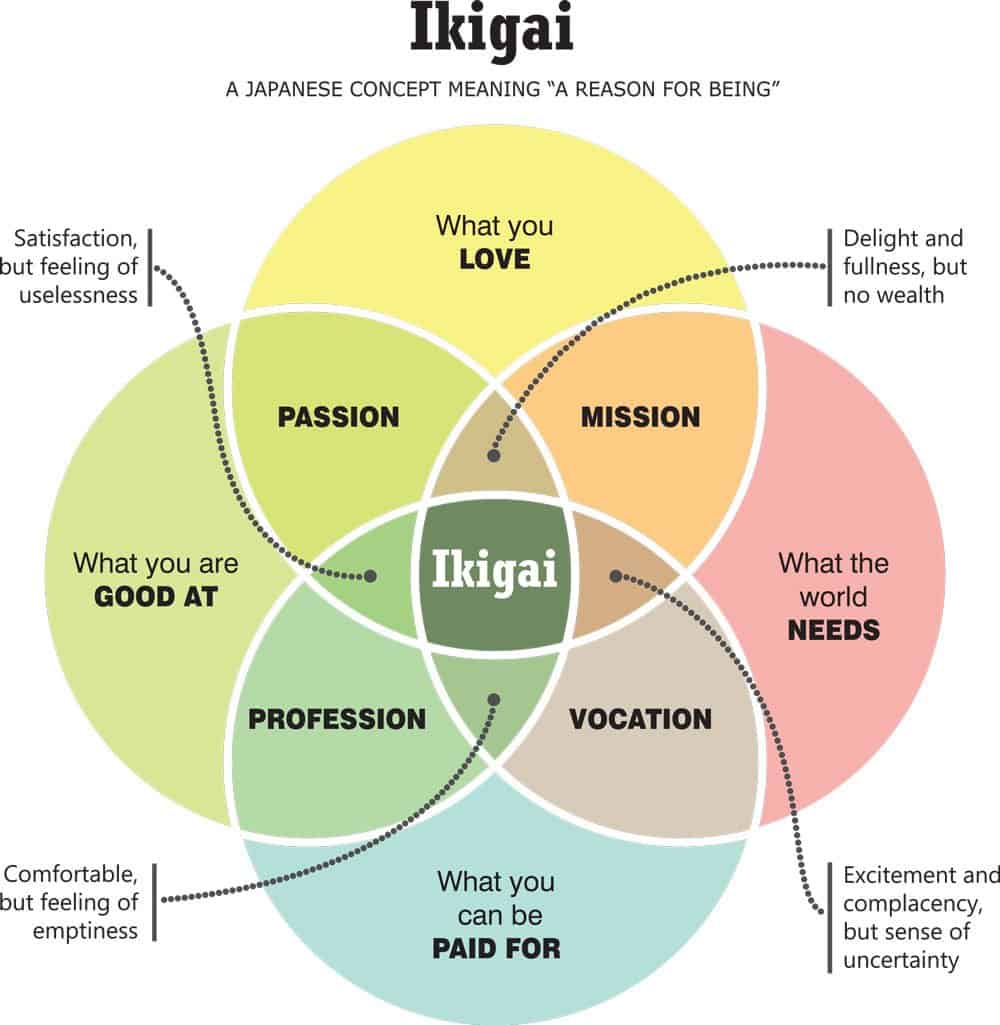

When we think about a family business, we can safely assume that in the business “circle”, there are a number of champions around, whether they be for a product or a project.

The role is actually most often actually part of someone’s job, and something that someone is specifically paid for. In fact, if they do it well, they may even get a nice bonus.

But every family business has another key circle, the family circle, where things are often much less clear.

Anyone who reads my blog regularly, knows that I always bring things back to the family and how tricky it can be to make sense of things there.

Momentum and Making Things Happen

Because it isn’t normally part of anyone’s “job”, making sure that things get taken care of in the family circle requires someone to be an instigator and a leader, and this person is often referred to as a “Family Champion”.

Joshua Nacht, who now works with the Family Business Consulting Group, has recently updated some of his PhD work and released a book entitled Family Champions and Champion Families.

In the book, he gives some great examples of who these champions are and the roles that they play.

The 100-Year Family Businesses Project

I asked Nacht how he came up with the idea for his PhD and he explained that Jaffe was his PhD supervisor.

Because Jaffe had recently launched a years-long project of finding and interviewing 100 family businesses that had each lasted a minimum of 100 years, he employed some of his students to conduct many of the interviews for him.

It was after doing a number of these in-depth interviews that Nacht and Jaffe realized that one of the keys to family business survival was to have someone who is interested, motivated, and capable of making sure that the family circle was never neglected in favour of the business circle.

Advisors Supporting the Family Champion

As an advisor who typically works with families who are beginning to work on family alignment and family governance, I am always on the lookout for those family members who are most open to the ideas that I bring.

The family champion role is often a lonely one, because many family members are preoccupied with their own lives and those of their nuclear family, rather than that of the extended family.

Outside advisors who learn to team with family champions, the ones with whom their messages resonate the most, are best positioned to create a lasting impact for the family, by supporting one another’s efforts.