A few weeks ago in Family Governance: One Step at a Time I noted that the Institute for Family Governance’s 3rd annual conference would end up inspiring at least a handful of future blog posts.

So here we are with the first of those.

It comes from the presentation by David York, who was making his first visit to IFG. I was already familiar with York’s work from his books and his past presentations at the annual Rendez Vous of the Purposeful Planning Institute.

I find York to be one of the more compelling speakers in the family wealth space, and you can see for yourself by checking out one of his TED talks, “A new way to think about inheritance”.

Estate-Planning Assumptions

At IFG he talked about some of the important assumptions that estate-planning attorneys typically make that should be questioned.

One of the main ones is that if transferring some wealth to the next generation is good, then transferring more wealth is better.

I think it’s perfectly understandable that most people make that assumption, because most of the time it makes sense.

But “most of the time” is not the same as “all of the time”, and that was York’s point.

A Dynamite Analogy

His analogy to explain this resonated with me so strongly that it became the inspiration for this blog post.

York stated that for some parents, handing down a huge chunk of wealth to their children can feel like giving them a lit stick of dynamite.

And, because of the prevalence of the “more is better” assumption, by the time all the technical specialists do their thing to maximize the size of the proverbial pie, instead of simply handing over one lit stick of dynamite, they can look forward to handing their kids two of them!

Parental Desires Meet Professional Customs

Part of the problem stems from the fact that most professionals have fallen into the same habits of treating their wealthy family clients in a homogeneous way.

For families that fall into a certain range of financial wealth, say the “seven figures” area, this would normally be sufficient.

But once you get into “eight figures”, and on up into nine and ten, those same rules just can’t be applied the same way.

Those parental fears about dynamite are real, but that doesn’t necessarily make them easy to discuss.

See video: How Much is Too Much?

Focus on Financial Wealth

The real issue is that so many of the family’s advisors focus solely on their financial wealth. It’s easy to see and to count, and it is pretty important. But it isn’t the only thing that the family cares about.

Sometimes the family leaders have an inkling that they should be trying to work on some of the family dynamics issues, but their advisors typically aren’t well versed in those issues and so the focus continues to be on the size of the pie.

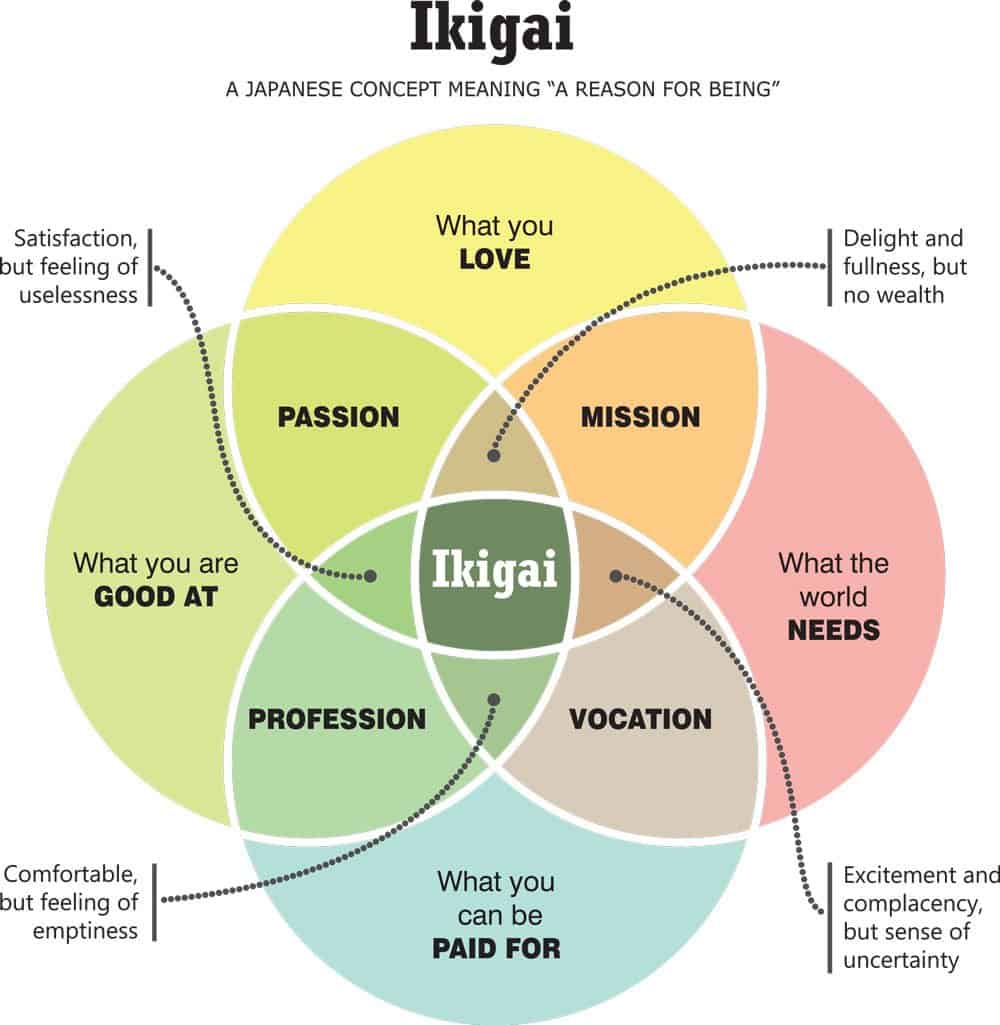

One of my favourite ways of talking about this is the simple equation that I wrote about a couple of years ago, in Is Your Continuity Planning PAL in Danger?

The equation is this:

People + Assets = Legacy

If you don’t include any planning around the people, and you only figure out what to do with the assets, you are missing out.

Family Office: Problem or Solution?

I’ve started to write more about Family Offices here, so let’s look at how things look from their point of view.

Is a family office part of the problem, or are they part of the solution. The answer, of course, is, “it depends”.

If the family office is mostly about financial wealth management, it is likely part of the problem, since it will be focused on producing more sticks of dynamite.

If, however, the family office also helps the family with their governance, their values and vision, and family alignment, then they can be a big part of the solution.

Human Capital

This all comes down to looking at those inheritors in terms of their human capital.

As York noted, most families would love it if their rising generation would be able to do just fine even if they did not inherit a single dollar from their parents.

And, he went on, those same parents would also love it if they had so much confidence in their children that they wouldn’t fear leaving them everything.

Is there anyone in your circle of advisors helping with those issues?